Upcoming Elections & Impact on Your Finances

In the last couple of months I’ve been on well over a dozen webinars and conference calls regarding the elections, politics, and the impact on the markets both short and long-term. I’ve also been updating & linking articles on our Market Outlooks page (click here).

It has been an unprecedented year in many ways and all of the emotions of the wide-ranging issues we’ve faced as a nation are coming to a head in the lead up to the election. With such a diverse range of opinions on policies, the direction of our country, Supreme Court replacements, and the personalities, character, and perceived ability to lead of our potential Presidents, it is no wonder that many people have strong feelings about what “a win for the other party” might do for your portfolios (and other future financial impacts, such as taxes, employment, etc.)

This has certainly mostly come in the form of Republicans concerned about a Biden victory (and potential Democratic majority in the Senate that would give a clean sweep of the 3 bodies necessary for passing more significant legislation) leading to “a market crash”. It’s understandable that is the main question because a Biden victory brings change and uncertainty about how the markets would respond to his agendas and priorities. A renewed Trump presidency brings less uncertainty for portfolios due to a 4 year track record of a healthy stock market (absent February and March with the pandemic), tax cuts that have already been in place, low Fed interest rates, and a generally business-friendly plan (although tariffs and trade policy have arguably had negative impacts on certain businesses in the short-term).

So, is this “the most important election of our lifetimes”? While I think that many of us can make that argument for policy, quality of life, and “direction of our country” issues that are important to us on either side (as the parties seem farther apart than ever in those areas), I don’t think that history allows us to make that leap to say that the future of the markets or your financial success will be determined by who is elected President in November. From American Funds’ “Guide to Investing in Election Years” we see examples for the following Key Takeaways:

From Invesco’s “10 Truths No Matter Who Wins” we see the following 10 “Truths” with supporting info and graphs:

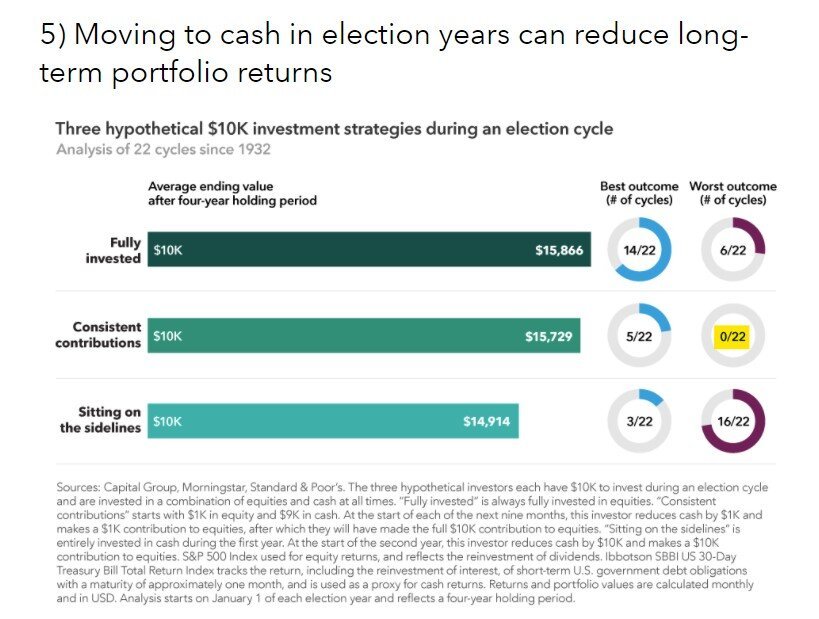

History has not been on the side of going to cash through investment years historically. Can it reduce the risk of a contested outcome this year? Sure. Could it also backfire and have you miss out on market gains? Absolutely. This becomes a personal decision that is going to be based on your risk tolerance and your time horizon for when you are going to need this money, but if you don’t need it in the next few years, the actual event of the election is unlikely to have made a big impact. According to the Capital Group research below, most cycles remaining invested has been the best outcome 4 years later. Only 3 out of 22 cycles has it been better to leave money in cash and invest after the elections. If you are investing still for retirement, continuing to make ongoing contributions (such as in your 401k) has never been the worst outcome.

Keeping in mind that the markets are so much bigger than even who occupies the most important job in the world as President. As Brian Levitt from Invesco stated:

“The case for equities has not changed. We still expect this nascent economic recovery to persist into 2021 and beyond. Betting against the economy getting better over the intermediate period is akin to betting against medicine, science, and human ingenuity.” Remembering that the market is about the sum total of the value placed on the ingenuity, creativity, and hard work of the leading business minds and hardworking employees is helpful for maintaining the long-term focus that will bring success to most investors.