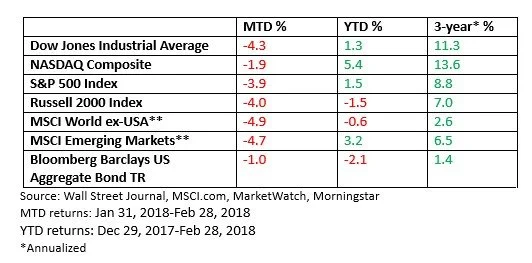

Market Review - March 2018

As we noted last month, the end of January and early February’s slide saw the S&P 500 Index lose just over 10% in value–an official correction–in just nine trading days. That’s right–nine trading days from an all-time high to a 10% decline which, according to LPL Research, was the quickest on record.

Let’s review the landscape. Moderate economic growth at home and abroad has been fueling corporate profits; analysts have been sharply revising 2018 profit estimates higher (Thomson Reuters); inflation has been low, and interest rates, while creeping upward, remain near historically low levels.

It created an ideal environment for stocks, i.e., low volatility and upward momentum.

However, when you’re priced for perfection, or something near perfection, any disappointments are likely to be amplified.

What sparked the sell-off? Yields on the 10-year Treasury were rising, which began to create a stiffer headwind for stocks. Higher than expected reported wage increases triggered inflation concerns.

But what likely would just have been a mild downturn snowballed. As we entered February, speculators who had piled into products designed to take advantage of low volatility were suddenly forced to jump ship, which exacerbated selling pressure in stocks. Further, computer program trading kicked in, adding to the turbulence.

Let me take a moment to repeat a familiar refrain. Making investment decisions during times of emotional duress is rarely profitable. While we know intuitively that tranquil periods won’t last forever, trying to time a peak or trough in the market is historically a near impossible task. Corrections can come suddenly, surprising the most astute market observers. There is no one out there who has consistently called the tops and bottoms in the market, period.

A sudden downdraft in shares can be unsettling for some. I understand that. I’ve heard a correction described as being blindfolded on a rollercoaster. You know there’s a bottom, you just can’t see it.

Walt Bettinger, CEO of Charles Schwab, summed it up well in a timely interview at the end of last year that was published in Fortune and picked up by Money.

“We don’t believe it’s possible for people at scale to beat the market and predict the market and know when to get in and out of the market,” Bettinger said. “Where most individual investors get in trouble is when the market goes down and they can’t stand the pain so they leave. Then they either don’t get back in or they wait until the market’s turned and gone way up and then get back in. That’s what really crushes individual investors.”

Portfolios must be built to navigate your specific needs and situations (not match an index or institution or your brother-in-law) with diversified components that take into account the fact that there will be good times and challenging times in these years ahead as we grow your accounts to meet your goals.

Bottom Line:

The early February downturn can be pinned on technical factors and not economic distress, in my view. The profit and economic outlook is upbeat, which I believe cushioned the downturn.

Interest rates, however, may tick higher. It’s something that could create headwinds in the nearer term, even as profit growth this year is forecast to accelerate (Thomson Reuters). Longer term, I am confident in the economic outlook.