Impact of Biden Transition - Look at Policies, Stimulus, & Taxes

Executive Summary:

Many have been asking questions related to the transition to Joe Biden with Democrat control of Congress after the Georgia Senate results. While certain expectations become apparent, much of the impact (which is what we all want to know) is still unclear. The markets are forward-looking and well aware at this point of the likelihood of tax increases (primarily on corporations and higher-income-earners above $400k), increased corporate regulations, and more (as detailed later). So far the markets have taken all of that in stride and increased significantly higher since the November elections (and even since Georgia) with the simultaneous expectation of a successful vaccine rollout by mid-2021, the economic recovery that would be expected to take hold with that, a continuing supportive Fed with low interest rates for the foreseeable future, as well as the innovation and productivity gains that many businesses will see benefits from going forward with this forced experiment of survival this past year.

Very close to 50% of the country is disappointed with the outcome of the elections and 50% are relatively happy. As in most transitions, those on the disappointed side expect the changes to specifically lead to a decline in the markets and economy (not to mention values, norms, and personal and societal well-being issues that are outside of this discussion). While I have a whole new set of things to pay attention to, I currently do not see a clear reason specifically to change strategy from an investment perspective (other than rebalancing for those without advisory accounts where some of your holdings may now be heavier towards the areas that have been most dominant) for most people who have not had changes in their own life situation. Being more balanced in portfolios has been a recurrent theme from much of what I read with expectations that Value, International, & Smaller company stocks could all see a relative revival this year after the dominance of Larger company Growth for the last several years.

There is enough data to show from history that we shouldn’t fear a market collapse just due to changes to a Democrat (or Republican again in the future) controlled Washington or in general to a unified government with no opposition. “Democratic sweep” hasn’t historically been the top-perfomer, but hasn’t been the worst either (and again those returns all have to do with much bigger issues than just who is in power anyway). And while split Congress has been the best for the markets over time (10.4% since 1933), a fully unified government hasn’t been far behind at 10%.

History is helpful, but obviously the question being asked now is “How will the changes proposed by Biden (and what can ultimately get approved by this Congress since there are moderate Democrats who may not go along with certain sweeping changes) specifically impact the markets & economy relative to other contributing factors of our economy that aren’t as directly impacted by those policies”? It’s easy to put so much focus on those policy items that we miss out on the positive market drivers that I mentioned at the end of the first paragraph of the Executive Summary. It’s also important for us to have clarity about what is actually being proposed in the Biden transition so that we make decisions from knowledge rather than fear or misinformation. Dave Ramsey’s team put together a good impact overview as well (with a focus on some other tax credits and proposals not covered as much below) that you can view here, and drives home the point that regardless of any administration, policies, proposals, or market responses, we are all still responsible for our personal financial outcomes and there is a lot we can control and still win with money despite outside circumstances. Those should remain the majority of our focus now and always.

Further Detail:

Let’s look more at some of those proposed policies and what is likely to be proposed in the near and farther term. This info is from Greg Valliere (Chief US Policy Strategist for AGF Investments), a long-time observer of Washington politics and their impacts on the economy and markets reflecting on the Biden agenda:

“With Democrats now in control of the Senate, they can use the budget reconciliation process, which requires just 50 votes to pass legislation, not 60 as under ordinary filibuster rules. Another stimulus bill thus is virtually certain…(with more details below of what was proposed).

The big impact of the Georgia results, in our opinion, is the Democrats’ control of tax policy. Another reconciliation bill later this year will raise taxes on wealthy individuals, corporations, capital gains, estates, etc.

The Biden agenda — taxes, spending, new regulations — will become a major issue for investors and more of what that agenda is looking like comes clearer day by day:

A SENSE OF URGENCY is a dominant theme. There’s a concern in Biden’s team that one or both of the houses could flip back to the GOP in 2022. A first-term president historically loses 5% of his congressional support in his first mid-term election. If that happens in two years, Biden could lose the House and Senate.

SO THERE’S NO TIME TO WASTE, despite all the distractions — an impeachment debate that could gobble up time, a Cabinet that hasn’t been confirmed, the need to pass a stimulus bill by early February, and most importantly a need to vaccinate millions of Americans. This latter issue already is frustrating Biden, who has snapped at his virus team for not being ready to roar out of the gate.

THE SLEEPER ISSUE: We’ll look at taxes in a minute, but it’s worth noting that an issue near the top of Biden’s agenda is climate change. Net zero emissions by 2050 is the very ambitious goal, which will require sustainable development, including investments in mass transit, charging stations for electric cars and retrofitting buildings to make them energy-efficient.

THERE’S A FUNDAMENTAL DIFFERENCE between the parties: Republicans say the Biden plan will cost jobs, while Democrats say it will create jobs. Biden’s activist environmental team believes carbon capture and sequestration technology is essential to reducing emissions from power plants as well as heavy manufacturing.

A SURE SIGN of how important this is to Biden: He will announce that the U.S. has rejoined the Paris climate control accord within hours of his inauguration next Wednesday.

REGULATORY REFORM: Biden will seek to reverse Trump regulations on dozens of issues — from antitrust policy, to drilling in Alaska, to light bulb standards. The Democrats’ control of both houses will make these reversals easier to attain.

TRADE POLICY: There’s a growing consensus in Washington — in both parties — that steep tariffs have not helped the U.S. economy. Biden probably will keep tariffs on China until there’s a new understanding between him and U.S. allies on how to confront Beijing. Relations with Canada, Western Europe and much of Asia will improve immediately; at the least, the tone will be more conciliatory.

THE BIG ISSUE — TAXES: We’re assuming that another stimulus bill, plus a more widely available vaccine, will get the economy humming by late spring. That means the Biden Administration will have flexibility to move on to the most controversial issue of all — major tax increases.

BIDEN IS VIRTUALLY CERTAIN TO PROPOSE a hike in the top individual rate from 37% now to 39.6%, and he probably will prevail on this. He wants to hike the top corporate rate from 21% to 28%, and something around 25% seems do-able. He also should prevail with a new minimum corporate tax of around 15%.

OTHER TAX GOALS WILL BE VERY CONTROVERSIAL, including any major change in estate taxes, taxing capital gains as ordinary income, imposing a new Social Security payroll tax, and enacting a Wall Street transaction tax. Moderate Democrat Joe Manchin of West Virginia won’t go along with huge tax hikes.

THE BIG IMPACT FOR THE MARKETS, of course, is how higher corporate taxes could affect earnings. A Bank of America analysis, reported recently by our friend Bob Pisani at CNBC, lists the following impacts on earnings: Technology, down 9.2%; health care, down 8.4%; communication services, down 8.2%; consumer discretionary, down 7.5%; financials, down 6.5%.

THERE WILL BE OTHER FACTORS, of course, that will affect corporate earnings, such as the positive impact on the financial services sector as higher interest rates raise their profits.

BOTTOM LINE: The Biden administration has so many goals — and such a thin congressional majority — that it will have to prioritize. What comes first after a stimulus bill? A higher minimum wage, rising to $15 per hour? A new trade plan? Immigration reform? All of these issues could get bogged down by impeachment and Covid-19.

AGAIN, THE BIG ISSUE BY SUMMER will be taxes. The financial markets apparently have shrugged off a negative impact, betting that the economy will be surging in six months. If it is, the threat of tax hikes will come sooner rather than later.”

We got more detail Thursday night on Biden’s proposed stimulus plan. There was question whether the proposal would be focused on COVID recovery relief or include layers of additional provisions including “infrastructure, green jobs, and expanded healthcare”. While he went big at a $1.9 trillion price tag, the proposals of this one are more focused specifically on COVID economic recovery. We could see another one later this year aimed towards those additional items that they would target having to pass through the budget reconciliation process (and likely include at least some corporate tax hikes to provide some revenue to cover.

More from Greg Valliere -

“WE’RE ABOUT TO FIND OUT just how skilled a negotiator Joe Biden is, as critics already are proclaiming that his pandemic relief bill is too expensive. Our initial bottom line — subject to change — is that Biden could get about $1.5 trillion of his $1.9 trillion proposal.

WE SUSPECT THAT THE PRESIDENT-ELECT deliberately included some provisions that will have to be whittled down. He might not get $400 billion for state and local governments, and the minimum wage might not rise to $15 per hour, at least not right away.

SO BIDEN “WENT BIG” because he will have to compromise to get a handful of centrist Democrats to accept a slightly reduced package. Joe Manchin, the moderate Democrat from West Virginia, will win some concessions as Biden seeks 50 Senate votes for a final deal — without using the reconciliation process, which he will save for the next bill.

OUR QUICK TAKE ON THE KEY PROVISIONS:

Weekly unemployment checks, maybe not extending until fall as Biden proposed, maybe not rising to $400 per week. But this will pass, even if it’s slightly pared down.

State and local government aid of $400 billion, which includes funding for testing and vaccines, will pass but the devil will be in the details for this provision. In some configuration, billions for vaccines and testing is virtually certain to pass. The vaccine rollout has been a “dismal failure,” Biden said.

$130 billion for schools, probably will pass, but might face a small reduction.

$1,400 in relief checks, which would equal $2,000 in aid after factoring in the $600 in checks that passed in late December, could get a haircut; Manchin is strongly opposed to this provision because it would send checks to people who are employed.

The $15 billion for small businesses in Biden’s plan could get increased.

Eviction protection is likely to pass, but maybe not extending thru fall.

Money for transit, $20 billion, could get reduced.

A significant increase in the child tax credit has support in both parties.

A rise in the minimum wage is likely, although the real action on this is at the state level. Biden’s call for $15 per hour may be aspirational.

THE NEXT BILL: If you think this one will be difficult, just wait until the next bill, which would propose spending several trillion dollars on infrastructure, green jobs, health benefits, etc. Senate Budget Committee Chairman Bernie Sanders is writing this next bill, which includes tax hikes. That could be the ultimate test of Biden’s negotiating skills.

HOW TO GET IT DONE? The first proposal after some negotiating probably will pass without going to the reconciliation option, but that might require some Republican support to cut off debate in the Senate. That’s possible but not easy. The second proposal later in the year would use reconciliation, which would require a simple majority, which Biden now has in both houses, but would still face intense debate, criticism and negotiation.

TWO MAJOR OBSTACLES: First, the impeachment, which could drag into February, complicating the passage of a relief bill. There’s support for conducting regular Senate business from morning till afternoon, then proceeding with the impeachment trial in the evening. Sounds plausible, but we’re not sure both of these issues can co-exist.

THE SECOND OBSTACLE — prepare to hear this for the next two years — is Sen. Joe Manchin and other moderate Democrats who are reluctant to support bills with massive price tags. The Democrats may have to persuade a couple of Republican Senators — Susan Collins or Lisa Murkowski — to get their package enacted.”

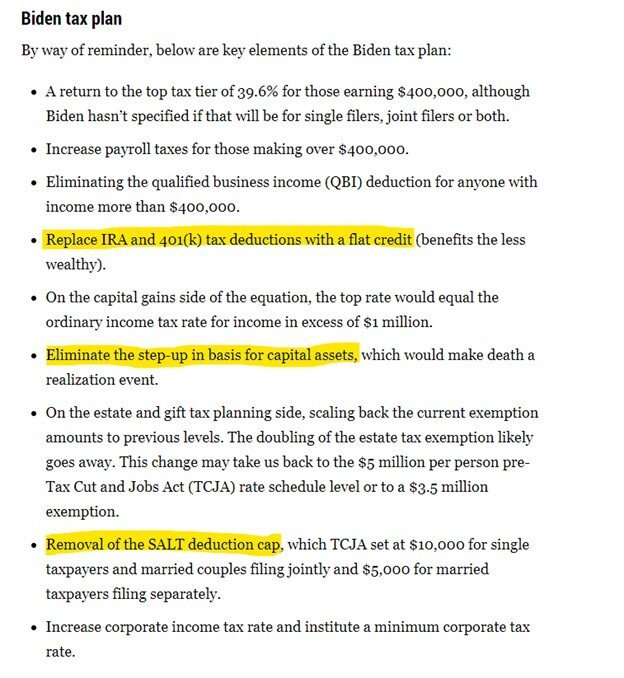

Additionally, here is more info on proposed tax changes from Horsesmouth:

While a good number of those provisions would be impactful for some of you in the higher income brackets above $400K, the main provisions of the tax code for the majority of Americans are not expected to meaningfully change. Details of the potential flat credit for IRA and 401(k)’s are unclear. Eliminating step-up in basis (of not having to pay gains on inherited assets like homes and non-retirement investment accounts) would be a scenario that hopefully cooler heads will prevail on and not change as that would be a logistical nightmare in certain cases to have to go back and determine cost basis on a home or asset purchase from potentially decades prior. The removal of the SALT deduction cap could be beneficial for many of us in California who itemize (rather than taking the Standard deductions of $12,550 for singles or $25,100 for married couples in 2021) as it would allow us to go back to not having totals of property tax and state tax deductions capped at $10,000.