Historical Market Responses To: War & Geopolitical Events

The war in Ukraine has been devastating and inexplicable at many levels and the primary focus should rightly be on the people and the humanitarian crisis that is unfolding. We know, however, that there are significant impacts financially that are playing out in real time as well, from stock market reactions, to economic sanctions, to the significant increases in energy prices. All of this, just 2 years after going through another unprecedented time of concerns over the unknown with the pandemic shutdown.

While it always seems like “this time it’s different” (and of course in many ways it is), the saying also goes “History doesn’t repeat itself, but it does rhyme”. In an age where information changes and updates us minute by minute what perspectives are we able to see by taking a step back and looking at previous geopolitical events? The charts below from First Trust give us some historical perspective on outcomes from previous conflicts to help shape big picture expectations while we navigate dramatic swings in the short term. I don’t dismiss short term concerns and current realities and only focus on history like some financial institutions seem to want to, but I also see that in a headline driven world many of us don’t take enough of that perspective at a time like this.

First, the biggest step back in time on this takes us back to the late 20’s and the Great Depression. As expected, this big picture view shows the market over time has significantly overcome a lot of major situations. The first thing that jumps out to me is that the 2 separate 8 year gaps in the last 20 years that we had without new major conflicts has been very rare historically, but as we look below we can see many other events since the 70’s that have brought reason for concerns about how the stock market will respond.

Over that period of time since 1970 the S&P 500 has returned 10.83% with $10,000 growing to $2,134,944. Much of the 70’s and early 80’s was persistent inflation similar to current concerns that we have. The major declines since the mid-70’s were obviously the early 2000’s and 2008. This begins the main theme, which is that most conflicts listed here and below had moderate short-term impact, but much less of a lingering impact unless coinciding with a recession (brought on by reasons not directly tied to the conflict typically).

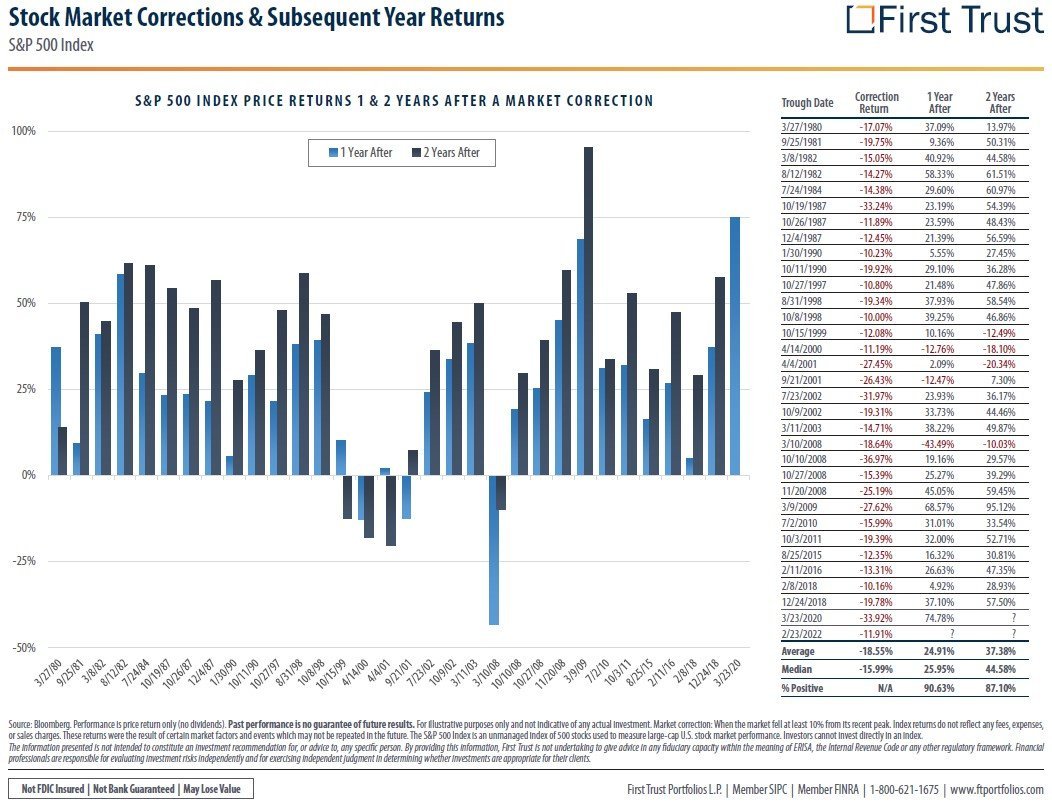

With now over 30 market corrections (S&P down more than 10% from peak) since 1980, we realize that this is a common (but not enjoyable) part of investing and while they may seem clear in hindsight, they rarely are in reality. The list of 6-9% declines where things would have seemed to be trending towards a correction before reversing and moving back higher would be extensive. Moving out of the markets at every (or even major) signs of trouble has historically been a losing proposition as the need to again time the re-entry point becomes vital and is difficult if based on emotions because the time things turn around rarely “feels right” and can lead to significant missed opportunities. Rules-based processes can help, but even those often miss out on the early significant recovery gains.

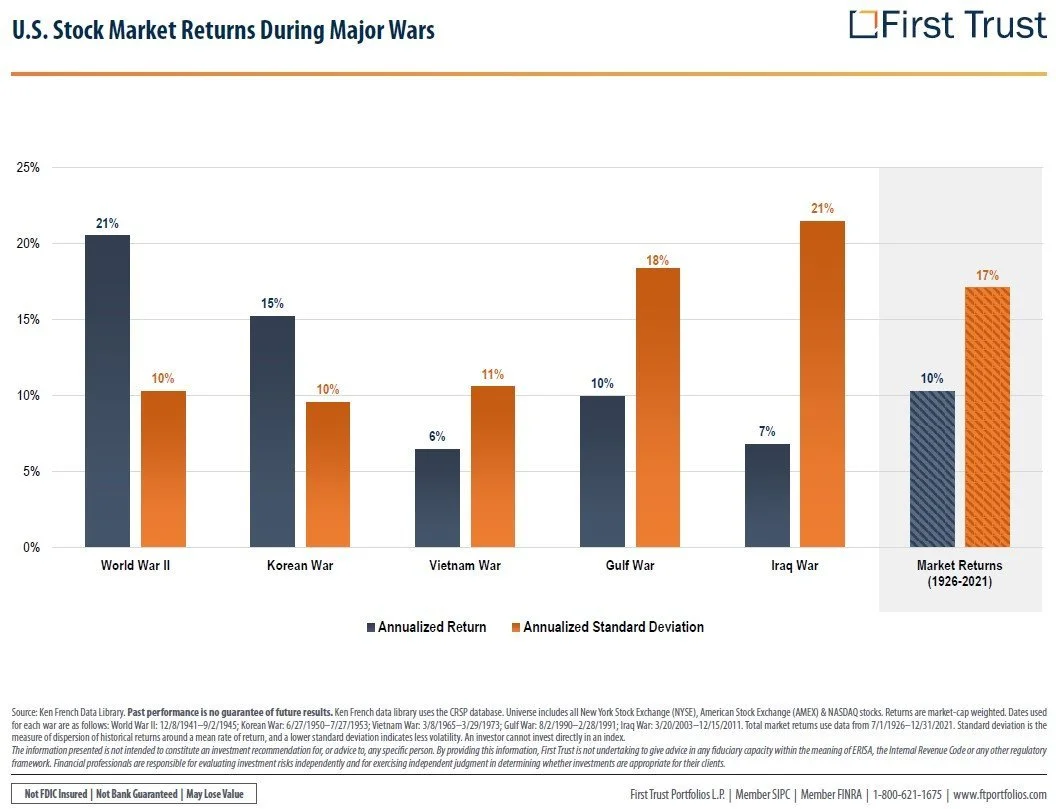

Intuitively people might expect war-time conflicts would lead to the “Uncertainty” that we always talk about the markets not liking, but historically the annualized returns during all of the 5 wars listed above have seen positive gains and not a dramatically different profile from the 10% long-term market returns since 1926 with similar volatility in most cases.

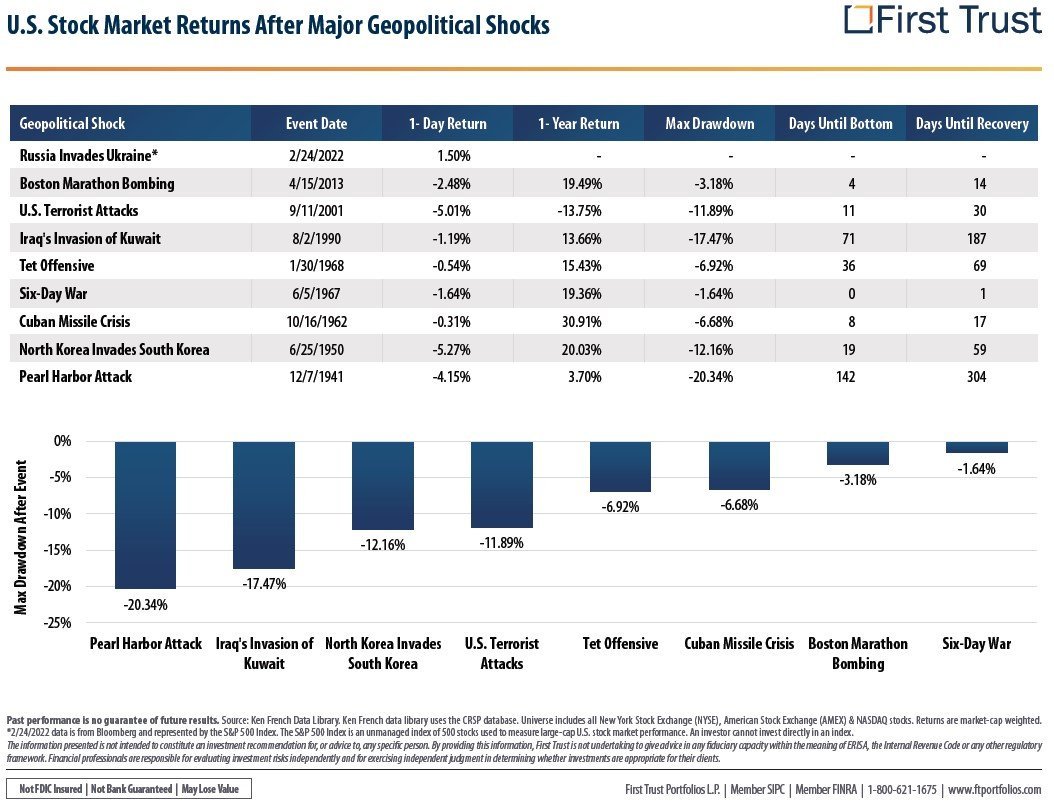

This last slide shows more specifically the short-term market responses to conflicts, the maximum drawdown during the conflict, and the length of time until recovery. Interestingly the current conflict is the only one listed where the market was up the day of the event (as declines were occurring prior with the tension buildup), but the 1 year returns are shockingly consistent where all but one (9/11 in 2001 that occurred while the US was still in the midst of recession) ended up positive (and in many cases significantly) a year later.

What does all of this mean for the current situation? I honestly wish I could say for certain that it means we have nothing to worry about, forget the short-term implications, and just focus on the long-term. There are too many variables at play currently of what could come out of this situation to ignore current realities and each investor is at different stages of life circumstances to make a broad statement like that. Current portfolio adjustments can be wise in this case and attempt to make the best of the situation, but much of that is on an individual basis. We want to avoid knee-jerk reactions to every crisis. In most cases still, slow and steady wins the race. Please reach out for anything you are thinking about. We want to be a help any way that we can.

*The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

All imagery & charts sourced from: First Trust