Market Review - January 2022

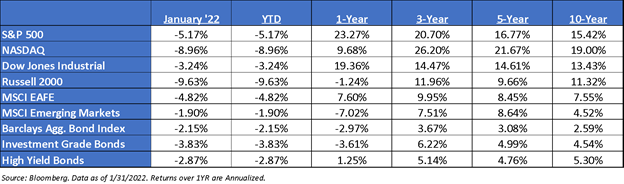

January did not get us off to the start we had hoped for in 2022 in many ways. Personally, our family finally all got Covid to start the year (along with many others of you who I’ve heard from) and then the markets started going the wrong direction in a hurry. While tensions in Ukraine and the rise of Omicron cases in January didn’t help the situation, the story of inflation and the Fed’s overdue response to how they’re now committed to fighting it were definitely the big culprit in the decline in markets (and especially the more growth-oriented tech stocks and small company stocks that gave us a lot of our gains coming out of the initial Covid drop).

Big month-end rallies continued a trend of big swings that has defined markets since the Federal Reserve signaled its intention to tamp down inflation that had swelled to the fastest since the early 1980s. In one session, the Nasdaq 100 erased a loss of almost 5%, while the S&P 500 staged three straight days with swings that topped 3%. Markets are finding themselves in a tug of war between strong earnings and economic growth, and the eye toward the Fed raising rates.

There are plenty of reasons why inflation is at a 40-year high: easy money and low interest rates, rising wages, supply chain disruptions, and fiscal stimulus that has fueled demand for consumer goods. And all of this is happening at a time when food and energy costs are rising.

Last year, the Fed insisted the jump in inflation would be temporary--“transitory” was its word of choice. But inflation proved to be more troublesome than they expected, transitory was retired, and the Fed quickly pivoted.

Gone are pledges to keep the fed funds rate at near zero through at least 2023. Instead, Fed Chief Powell seems determined to bring inflation back under control, and that means the Fed is contemplating a series of rate hikes in 2022.

His more aggressive approach created volatility in January, as investors attempted to price in several rate hikes this year. During the January meeting, the Fed did nothing to contain market expectations to four (4) rate hikes this year, effectively inviting the market to price in even more, hence why the market saw a swift move. Furthermore, Powell also hinted that he will be revising up his 2022 inflation forecast, which will pressure the dots higher.

At the same time, market participants are pricing in the potential for as many as five rate hikes (with some projecting 6 or 7) by the Federal reserve this year, with some looking for the first hike in March to be 50 basis points and likely settling in around 1.75% or 2.00%. We continue to think that the higher hawkish estimates will prove to be overblown as the Fed reviews the data through the year. The current Federal Reserve has been both hyper transparent, and steadfastly deliberate in their actions. The potential for them to do anything that surprises the markets seems unlikely.

The Fed’s challenge: engineer a soft economic landing, which brings down inflation without throwing the economy into a recession. We are currently in good shape on that compared to other periods of high inflation and/or recessions with inflation currently being the main negative as seen below, but there have been times in history where the Fed has overplayed its hand.

Corporate earnings and growth have mostly been strong with many companies beating estimates handily, with some high profile misses with Netflix, Peloton and most recently Facebook. The key risks to watch: (1) Supply chains, (2) oil, (3) labor costs, (4) the Fed tapering cadence, (5) Omicron variant effects, and (6) China growth.

Recent Rate Hikes Cycles:

Looking at recent history, during the 2004 to 2006 rate-hike cycle, then-Fed Chairman Alan Greenspan said rate increases were likely to be “measured,” as he embarked on a series of quarter-point rate hikes. His goal: reassure investors and avoid rocking financial markets. Fed Chief Janet Yellen and later Powell also soothed anxieties by signaling rate hikes would be “gradual” when rates slowly began to increase in late 2015. “Gradual” wasn’t as clear as “measured,” but the goal was the same: reassure investors.

Greenspan and his successor Ben Bernanke raised the fed funds rate from 1% to 5.25% in a predictable series of quarter-percent increases. Yellen and Powell hiked the benchmark rate from 0%-0.25% to 2.25%-2.50% through an uneven series of .25% increases.

At Powell’s late-January news conference, he wasn’t making any promises on how quickly rates might rise. He wouldn’t rule out a rate hike at every meeting, beginning in March (there are eight scheduled meetings each year, including January). He didn’t dismiss the possibility of a 50bp increase. And, there was no mention of 'gradual' or 'measured.'

The last time the Fed was truly aggressive was back in 1994, when the Fed implemented several 50bp increases and one 75bp hike. Rates doubled from 3% to 6% in one year. During each of those tightening cycles, including 1994, inflation was under control. The Fed acted preemptively. Today, it is reacting to high inflation.

We are not saying we’re going to see a repeat of 1994. Powell warned that inflation could remain stubbornly high this year, but it’s certainly possible supply chains will settle down and lessen the need for a strong central bank response or that economic data slows and makes them more hesitant to keep raising. (Federal Reserve, St. Louis Federal Reserve) Barring a significant health crisis or a major geopolitical event, the Fed’s new posture will probably be the main market focus this year.

I hope you’ve found this review to be educational and helpful. If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call. We are honored and humbled for the opportunity to serve in this important part of your life.

*Thank you to Horsesmouth, Aptus Capital Advisors, and Main Management for some of the resources that contributed to this post. The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.